Decorating Allowance

When a cash back is involved it doesn’t normally serve the purpose

intended because the insurer/lender will deduct the cash back from

the purchase price and lend based on this value.

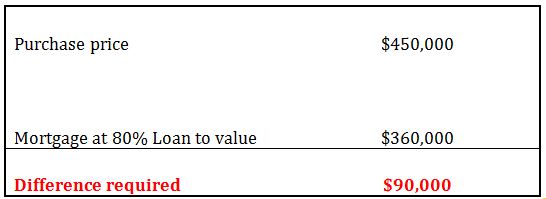

The scenario below is based on a $10,000 cash back on a mortgage that represents 80% of the purchase price:

The scenario below is based on a $10,000 cash back on a mortgage that represents 80% of the purchase price:

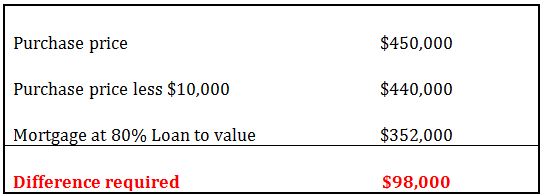

With option 2 clients will be required to bring in $98,000, difference between the purchase price of $450,000 and $352,000 mortgage.

As you can see $8000 of the $10,000 cash back will be required to offset the difference between Option 1 and Option 2 which means at the end of the day clients end up getting $2000 ($10,000 less $8000) credit to use towards decorating allowance.

As you can see $8000 of the $10,000 cash back will be required to offset the difference between Option 1 and Option 2 which means at the end of the day clients end up getting $2000 ($10,000 less $8000) credit to use towards decorating allowance.