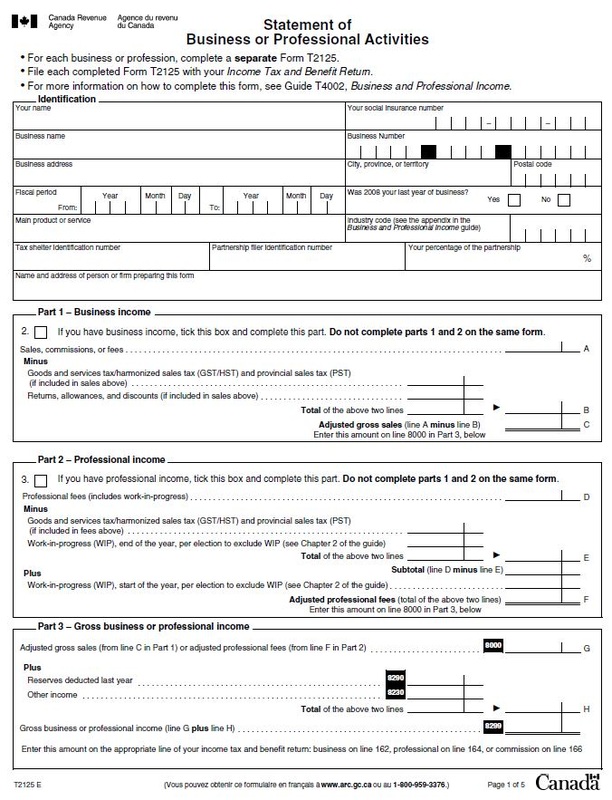

What Is A Statement Of Business Activities

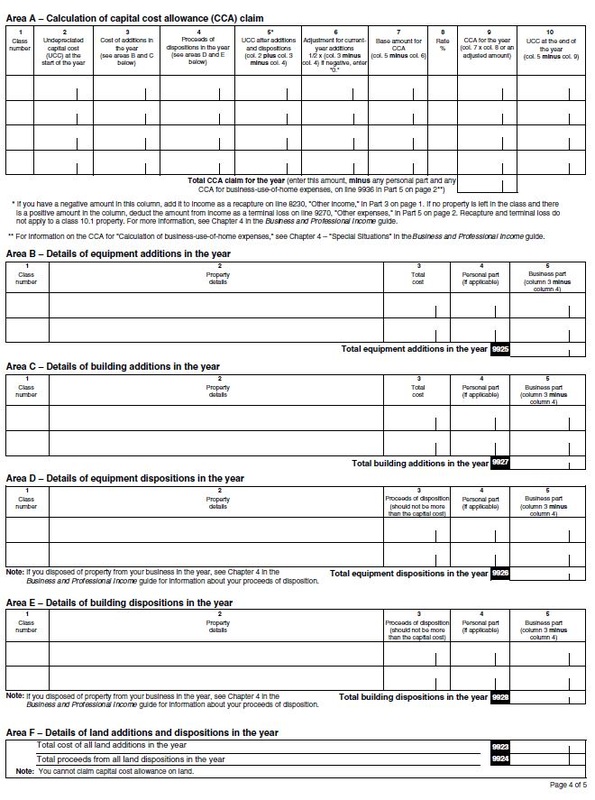

The Statement of Business Activities (T2125 tax form) is used to calculate your business or professional income as a self-employed person. Use it if you are the only person in the business (sole proprietorship) or if you are in business with one to five other people (partnership).

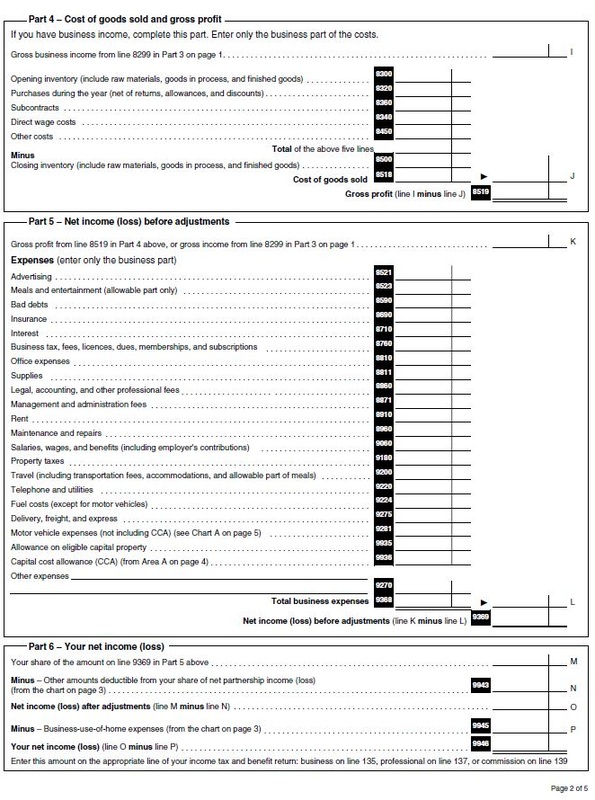

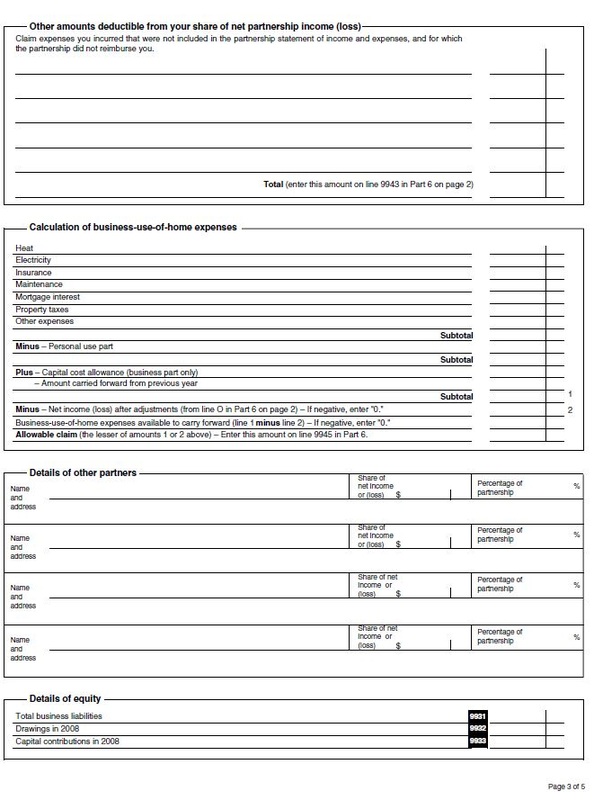

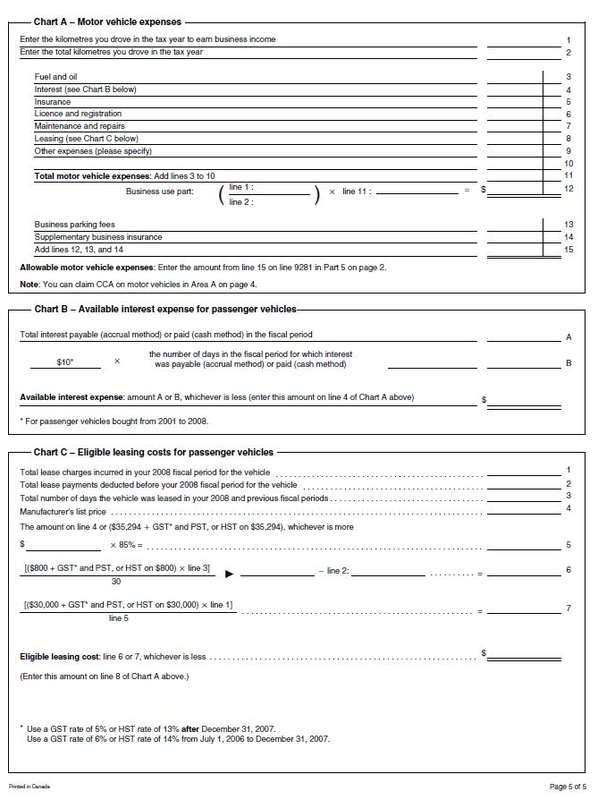

You calculate your gross income and your net income after deducting all your business expenses like advertising, rent, home office and motor vehicle expenses.

This information is not intended to provide tax advice or any other advice.

You calculate your gross income and your net income after deducting all your business expenses like advertising, rent, home office and motor vehicle expenses.

- You are self-employed if you control the time, place, and manner of performing your activities; supply your own equipment and tools, and assume the rental and maintenance costs; make a profit or incur a loss, and cover operating costs; and integrate your client's activities into your own business activities.

- You are an employee if your employer decides where, when, and how the work is to be done; establishes your working hours; determines your salary amount; supervises your activities; and assesses the quality of your work.

This information is not intended to provide tax advice or any other advice.