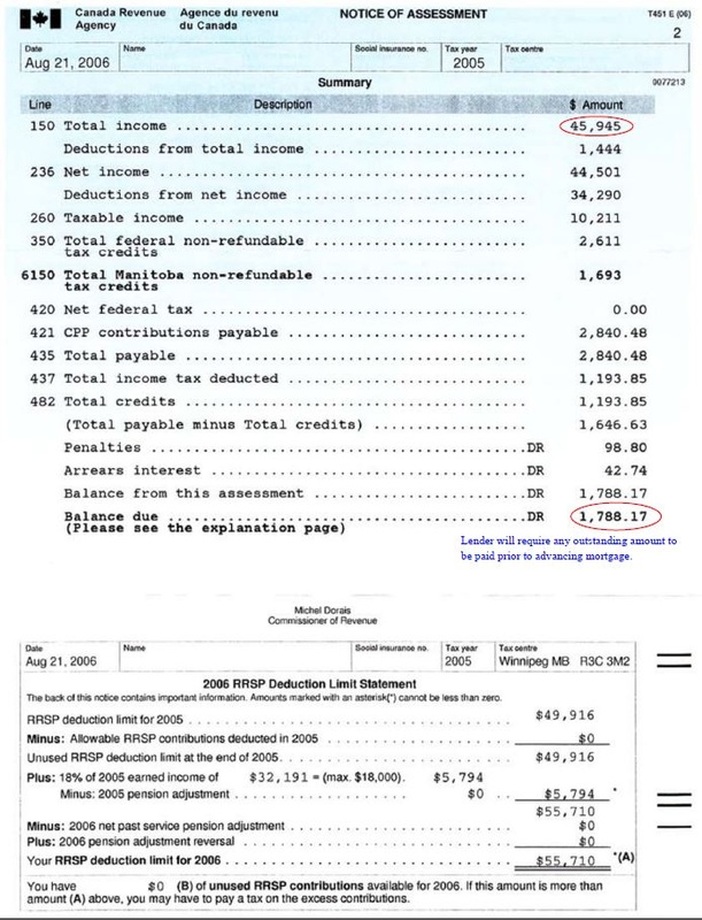

Notice Of Assessment - Noa for short

A Notice of Assessment form is usually a 1 or 2 page form (normally light blue in color) that Revenue Canada sends back to you as a summary of your received Tax Return. It will either contain a refund cheque or a bill for your outstanding taxes for the previous tax year. It will include the date, your full name, SIN number, tax year and tax centre clearly indicated in the top row of the page.

Lenders require this document for 2 reasons:

Tax arrears could be placed on title of your home and take priority over any mortgage financing in a sale of the property. The lender will require the tax arrears to be brought up to date before advancing mortgage funds.

You can obtain a duplicate copy by contacting the Canada Revenue Agency, or by logging into your account with them at http://www.cra-arc.gc.ca/esrvc-srvce/tx/ndvdls/myccnt/menu-eng.html. If you have an account with Canada Revenue Agency, you can view and print your NOA’s for the past 11 years.

Lenders require this document for 2 reasons:

- To confirm your taxable income as per line 150.

- To confirm if there are any outstanding taxes owed to Revenue Canada.

Tax arrears could be placed on title of your home and take priority over any mortgage financing in a sale of the property. The lender will require the tax arrears to be brought up to date before advancing mortgage funds.

You can obtain a duplicate copy by contacting the Canada Revenue Agency, or by logging into your account with them at http://www.cra-arc.gc.ca/esrvc-srvce/tx/ndvdls/myccnt/menu-eng.html. If you have an account with Canada Revenue Agency, you can view and print your NOA’s for the past 11 years.