Purchase plus improvements

Purchase plus improvements is a program designed for people who would like to do some renovations where the improvements will increase the value of the property.

If a buyer wants to use the purchase plus improvement program they must obtain a quote (detailed list of improvements from a third party outlining scope of work and cost estimates) from a contractor for the improvements to be done to the home. The contractor quote needs to be provided at the time of purchase as the lender needs to qualify based on the value plus improvement. The work to be done should be carried out by the contractor providing the quote as the lender has to be satisfied that the work matches the quote.

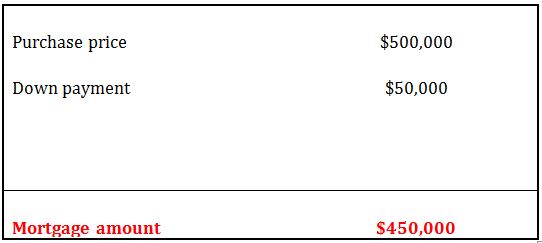

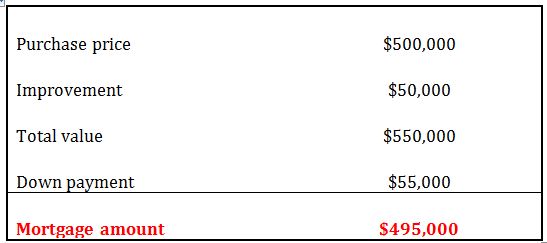

In this example, the down payment is 10%. With the traditional purchase the down payment is $50,000 (left column) where no improvements would be required versus $55,000 (right column) based on value plus improvement. Please note I did not include the insurance premiums and the premiums are added to the mortgage and that is what your payments are based on. The same applies if clients are putting 5%, 15% down etc.

If a buyer wants to use the purchase plus improvement program they must obtain a quote (detailed list of improvements from a third party outlining scope of work and cost estimates) from a contractor for the improvements to be done to the home. The contractor quote needs to be provided at the time of purchase as the lender needs to qualify based on the value plus improvement. The work to be done should be carried out by the contractor providing the quote as the lender has to be satisfied that the work matches the quote.

- CMHC allows $40k, to a max of 10% of the "as improved" value.

- Genworth allows 20% of "as is" value, to a max of $40k.

In this example, the down payment is 10%. With the traditional purchase the down payment is $50,000 (left column) where no improvements would be required versus $55,000 (right column) based on value plus improvement. Please note I did not include the insurance premiums and the premiums are added to the mortgage and that is what your payments are based on. The same applies if clients are putting 5%, 15% down etc.

Note: The solicitor will “hold-back” on closing the “improvement” portion of the mortgage until the work has been completed. Once the work has been completed, the lender will require confirmation and the solicitor will then advance the balance of the funds and the contractor can be paid back.

You will either have to find a contractor that will agree to receive pay after the renovations are completed or arrange to pay the contractor up front and then you will be reimbursed after the solicitor releases hold-back.

You will either have to find a contractor that will agree to receive pay after the renovations are completed or arrange to pay the contractor up front and then you will be reimbursed after the solicitor releases hold-back.