Understanding Your Credit Score

As credit has become more and more abundant in our society, your credit report, and thus your credit rating, has become more important in your daily life. Your credit rating affects all aspects of your financial activities when it comes to borrowing money. Your credit rating also has the ability to affect the job you get, the apartment you rent, and even the ability to open a bank account.

Your credit report itself is simply a listing of all of your mortgage and consumer debt. Here in Canada, the two main credit reporting agencies are Trans Union and Equifax. Both agencies have a credit history file on anyone who has ever borrowed money. Every time you borrow money, or make a payment on a loan or credit card, the lender then reports the information about the transaction to these two agencies. In addition to credit information, you will also find liens and judgments on your credit report as well as your address and possibly your work history. The accumulation of all of this information is called your credit report.

The information on your credit report varies based on your creditors and what they have reported about you. Potential lenders and others, such as employers, view your credit history as a reflection of your character. Whether we like it or not, our financial habits have a lot to say about the way in which we choose to live our lives.

The credit score, or beacon score, is a number which gives mortgage lenders an idea of your lending risk.

Credit scores range from 300 to 900, the higher your credit score the better. The mortgage products and interest rate that you will qualify for are often determined by your credit score.

One thing that many people do not know is that you have the legal right to obtain a copy of your credit report. A mortgage professional can help you obtain a copy of this report and go through it with you to verify that all of the information is true and correct.

The good news is that your credit report is a working document. This means that you have the ability over time, to repair any damaged credit and increase your credit score.

How does this number work?

Your credit report itself is simply a listing of all of your mortgage and consumer debt. Here in Canada, the two main credit reporting agencies are Trans Union and Equifax. Both agencies have a credit history file on anyone who has ever borrowed money. Every time you borrow money, or make a payment on a loan or credit card, the lender then reports the information about the transaction to these two agencies. In addition to credit information, you will also find liens and judgments on your credit report as well as your address and possibly your work history. The accumulation of all of this information is called your credit report.

The information on your credit report varies based on your creditors and what they have reported about you. Potential lenders and others, such as employers, view your credit history as a reflection of your character. Whether we like it or not, our financial habits have a lot to say about the way in which we choose to live our lives.

The credit score, or beacon score, is a number which gives mortgage lenders an idea of your lending risk.

Credit scores range from 300 to 900, the higher your credit score the better. The mortgage products and interest rate that you will qualify for are often determined by your credit score.

One thing that many people do not know is that you have the legal right to obtain a copy of your credit report. A mortgage professional can help you obtain a copy of this report and go through it with you to verify that all of the information is true and correct.

The good news is that your credit report is a working document. This means that you have the ability over time, to repair any damaged credit and increase your credit score.

How does this number work?

- This three digit number is a statistical formula that takes your personal credit information from your credit report

- Scores range from 300 - 900

- The ‘Beacon Score’ is branded by Equifax

- FICO – Fair, Isaac & Co (created to assess profitability)

- Everything counts: age, address, phone number, dependents, length of employment with same employer

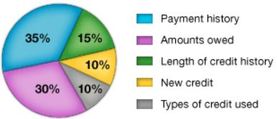

- Utilization = 35%

- Type of credit = 10%

- Level of indebtedness = 30% (65% mark)

- Inquiries = 10% (kept on record for 3 years)

- Length of credit history = 15%

- Might want to keep trades that have a long and positive history

- Employer on credit bureau

- Equifax charges customer for electronic delivery but not via mail

- Bad debt stays on for 7 years

The Nine Point Credit Rating Scale is as Follows:

- R0 Too new to rate; approved but not used.

- R1 Pays (or paid) within 30 days of billing; pays account as agreed.

- R2 Pays (or paid) in more than 30 days, but not more than 60 days, or one payment past due.

- R3 Pays (or paid) in more than 60 days, but not more than 90 days, or two payments past due.

- R4 Pays (or paid) in more than 90 days, but not more than 120 days, or three or more payments past due.

- R5 Account is at least 120 days overdue, but is not yet rated 9.

- R6 (Code 6 does not exist.)

- R7 Making regular payments under a consolidation order or similar arrangement.

- R8 Repossession (indicate if it is a voluntary return of merchandise by the consumer).

- R9 Bad debt; placed for collection; skip